22/02/2024

Platinum Group Metals Market Research Insights

Widely engaged in numerous industrial applications, platinum group metals (PGMs) have been listed on the EU Critical Raw Materials since 2021. Due to their exceptional catalytic activity, high melting points and stable chemical properties, PGMs have been widely used in automotive catalysts. Statistics show more than 56% of PGMs have been utilised over the past decade in the production of automotive catalytic converters. The demand of PGMs at EU level is pronounced, due to more rigorous emission regulations. However, the recent shift in demand dynamics within the EU, mainly justified by the deployment of electric vehicles, generated a market decline in platinum (Pt) demand from the automotive sector. Beyond autocatalysts, PGMs find applications in various sectors: the chemical industry, where they serve as catalysts, as well as the electrical industry, where they are utilised in printed circuit board assemblies (PCBAs) and electronic components such as capacitors. Additionally, PGMs are employed also in the medical, dentistry, fuel cells, and jewelry sectors.

Despite their essential role in numerous industries, the energy required for the recycling of PGMs remains a concern. However, the energy consumption for recovery of PGMs from spent autocatalysts (SAC) is significantly lower than mining primary resources from ores which are moreover recording progressive depletion in time.

Latest PGM market insights

The latest statistics presented in 2021 reported a primary supply of PGMs amounting 423 tonnes which covers 69% of the market, with recycled material supplementing the remaining share. Catalyst production, predominantly for automotive industry, accounted for approximately 56% of the supply usage, with 39.4% of Pt, 84.7% of palladium (Pd), and 90.6% of rhodium (Rh) dedicated to this sector. Despite fluctuations, the demand of Pt in Europe remained robust, fuelled by the diesel market and a rebound in vehicle sales following the recession period. More recent focus on green hydrogen production via electrolysis displayed shown by France, Spain, UK and Norway could increase considerably the demand of Pt.

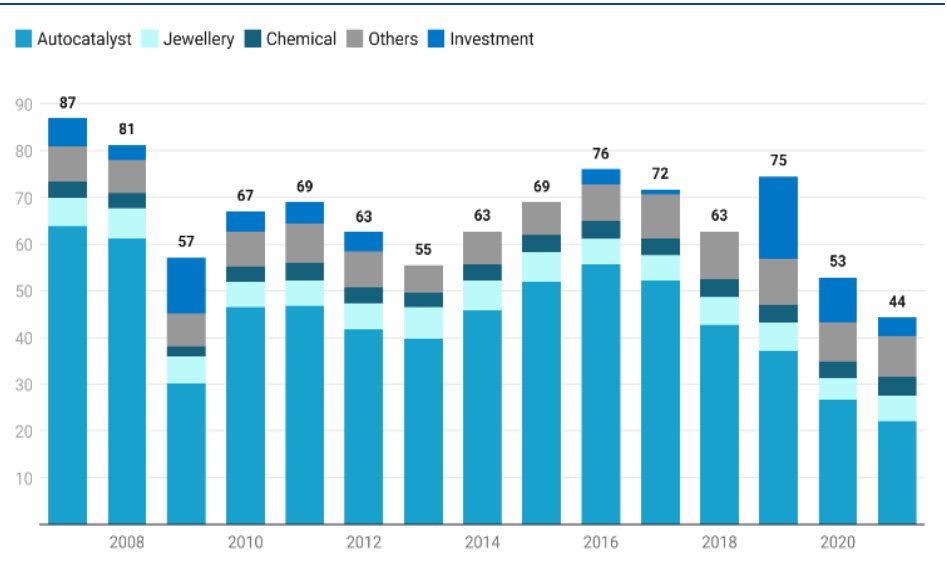

Evolution of platinum consumption in Europe13, 2007-

2021, tonnes of Pt, elaboration based on data from (JM, 2022a) (JM, 2022b)

Several factors shape the dynamics of the PGM market:

- Short-term market trends: A resurgence in sales and the implementation of stricter emission standards are currently reshaping demand patterns.

- Long-term Outlook: The transition towards a hydrogen economy presents promising opportunities for PGM demand, particularly in emerging applications like electrolysers and fuel cells. This shift also generates competition between fuel cell vehicles and electric vehicles in the green transportation sector.

More information about the supply and demand of PGMs available in the SCRREEN factsheets.

FIREFLY solutions in the market landscape

As we navigate the market dynamics, the FIREFLY project is placed at the forefront, leveraging insights to drive research and innovation towards more sustainable chemical operations in Europe. By closely monitoring market trends, we ensure that our initiatives align with broader objectives of energy security, sustainability, economic growth and circularity.